The buyers plan to renovate the REIT’s flagship Paragon mall on Orchard Road

Paragon REIT unitholders overwhelmingly approved Cuscaden Peak’s privatisation of the SGX-listed retail trust at a Tuesday meeting, paving the way for a potential disposition of the portfolio’s three remaining properties.

The privatisation scheme passed with the support of unitholders representing 97.57 percent of the total value of units held by unitholders present and voting in person or by proxy, according to a filing with the Singapore Exchange.

The buyout by Cuscaden Peak, a 50:50 holding company of Temasek-owned firms Mapletree and CapitaLand, values the trust at S$2.8 billion ($2.1 billion), representing a 7.1 percent premium to adjusted net asset value. Cuscaden owns 61.5 percent of the REIT and abstained from the unitholder vote.

Beyond its Paragon flagship on Orchard Road, the trust formerly known as SPH REIT owns Clementi Mall, a suburban shopping centre in Singapore, and holds a 50 percent stake in Westfield Marion Shopping Centre in Australia. Cuscaden said the privatisation would free up cash for asset enhancement initiatives without exposing unitholders to associated risks and volatility.

“If successful, unitholders can monetise their investment fully in cash at an attractive scheme consideration, and if desired, reinvest in other opportunities,” the state-backed company said.

Winding Up SPH

Paragon accounts for 72 percent of the trust’s portfolio by asset value after last year’s divestment of The Rail Mall in Singapore and the sale of an 85 percent interest in Figtree Grove Shopping Centre in Australia.

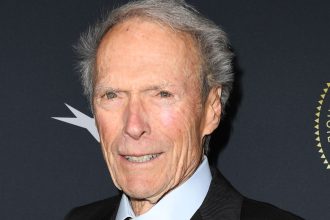

Cuscaden Peak CEO Gerald Yong

Those sell-offs were part of a string of disposals of properties formerly linked to Singapore Press Holdings, which Cuscaden acquired through its 2022 takeover of SPH’s property arm.

Cuscaden Peak CEO Gerald Yong has said the privatisation of the REIT will enable the buyers to carry out renovations at Paragon. The REIT’s flagship asset, housing 289 tenants in its six floors and a basement, has been an Orchard Road mainstay for over three decades, but its last major renovation was 15 years ago.

Cuscaden plans to invest between S$300 million and S$600 million in upgrades to Paragon without redeveloping the property, altering its use or expanding its gross floor area. The renovation is set to unfold in phases over three to four years to keep the mall operational throughout the process.

Tycoon’s Exit

Hotel Properties Ltd, led by tycoon Ong Beng Seng, was originally part of a three-company consortium that bought SPH’s real estate business, including Paragon REIT’s manager. After the acquisition, the consortium privatised the company in 2022, forming Cuscaden Peak.

Paragon REIT disclosed to the Singapore Exchange in January that HPL had exited its stake in Cuscaden, leaving its two Temasek-controlled shareholders with an even split of ownership in the holding firm.

HPL announced last week that billionaire Ong, who is set to plead guilty for his role in a corruption scandal, had stepped down as managing director and would not seek re-election to the company’s board.