OurPass Microfinance Bank, led by CEO Eze Samuel, is facing backlash from customers who are unable to access their fundsDespite promises to resolve the issue, the bank has not addressed the ongoing financial distress, leading to growing customer complaintsMeanwhile, the CEO remains silent as the bank’s credibility continues to suffer amidst these unresolved challengesLegit.ng journalist Zainab Iwayemi has 5-year-experience covering the Economy, Technology, and Capital Market.

In mid-2024, Kanyinsola (not a real name), who is involved in the food processing and exporting business, was approached by Samuel Eze, the founder of a microfinance bank. His shared vision for the project was so impressive that one could see the passion in his eyes as he talked about making the bank the next go-to forum for all kinds of banking in the near future.

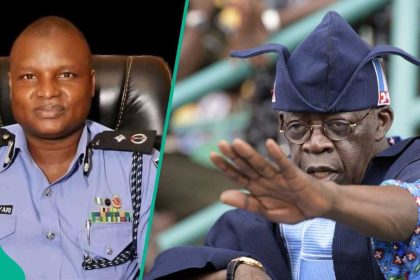

CEO Eze Samuel faces mounting pressure as OurPass Microfinance Bank struggles with unresolved issues affecting business funds. Photo Credit: Contributor

Source: Getty ImagesBeing a core Nigerian not easily swayed by mere talk, Kanyinsola swung into action, entering the name of the bank on Google, “OurPass Microfinance Bank.” With a single tap on keyboard, what she saw further cemented her conviction that the bank could be the next big fintech, helping to simplify payments for businesses. The bank had recently acquired a microfinance license and hoped to serve enterprise customers.

She was excited to start the journey, transferring a large sum of money meant for business operations into the bank. To her, she wasn’t just banking; she was helping to build something that would, in turn, become the next fintech business, ready to compete with players like Moniepoint, Opay and others focusing on large corporates such as Shoprite, Medplus, UAC Foods, and SPAR.

Unknown to her, this step would later become one of the greatest regrets of her life.

Fast forward to November 2024, Kanyinsola needed to withdraw money for some business transactions and realised several withdrawal attempts were unsuccessful.

“I mostly make deposits with the bank and no withdrawals, which made me unaware of the financial distress the bank was (and still is) facing, and how customers don’t get access to their money immediately after making a deposit.”After numerous attempts to withdraw the N25 million deposit, she succeeded in withdrawing a paltry amount, leaving her with over N23 million still in the bank.

She said, “There were days when I was able to withdraw N200k, and there were days when I got less than that. I kept trying every minute until I was able to get a tiny bit of my money before withdrawals were later stopped completely.”Similar to Kanyinsola, John started banking with OurPass in 2021, as far back as when the bank secured its pre-seed funding in September 2021 with the ambition to become the “Fast for Africa.”

He said, “They appeared to be licensed as a microfinance bank and partnered with Vbank.”He noted that for years, he was able to make transactions without any issues using the platform until he started noticing problems with the bank in November 2024, shortly after it acquired a license from Nigeria’s Central Bank.

The bank, which promised business accounts, loans, and business management tools for businesses, seemed to have delivered headaches for businesses and their owners by restricting access to capital.

John, who had over N5.7 million with the bank, shared with Legit.ng how the bank had affected his company’s operations. He only wanted to try out an innovative solution but now regrets his actions.

“We have other platforms we use to receive payments. But, with the way the media is promoting OurPass, as a tech company, you would want to test the innovation.”Attempts to reach outSJohn started banking with OurPass in 2021 due to its innovative payment solutions offering. account be closed and a refund issued. However, all attempts to resolve the issue have been met with promisesSimilar to to address the ‘technical challenges’ that have persisted for months.

As the issue remained unresolved for over 8 months, affected customers soon noticed that the bank blocked access to its app, restricted communication channels, and deleted negative comments on social media.

Customers also confirmed to Legit.ng that the bank’s office in Victoria Island had been closed for months.

Meanwhile, as of press time, Samuel Eze has yet to respond to any questions concerning the allegations.

Frustrated customers of OurPass Microfinance Bank demand answers as failed withdrawal attempts continue to plague the platform. Photo Credit: OurPass Microfinance Bank

Source: Getty ImagesMore complaintsRecent reports by Techpoint confirmed that the company may have bullied its workers, leading many employees to leave. Workers characterised Eze as an erratic and unpredictable boss. In 2023 and 2022, respectively, co-founders Rogers Mugisa and Gbeminiyi Laolu-Adewale departed the firm.

“Sam would make a promise one day and contradict himself the next,” a former employee said. “He’s a bully,” another former employee said. “He would sabotage an idea and still blame you for it.”Moniepoint gets approval to acquire Kenyan Bank Legit.ng reported that Nigeria’s fintech unicorn, Moniepoint, has been cleared by the Competition Authority of Kenya (CAK) to acquire a 78% stake in Kenya’s Sumac Microfinance Bank.

If completed, the deal will allow the Nigerian fintech to enter into Kenya’s tightly regulated banking sector.

The move comes after Moniepoint’s plan to buy payment company Kopokopo collapsed.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Source: Legit.ng