Africa is home to some of the world’s most influential business moguls, whose fortunes stretch across industries like cement, telecoms, luxury goods, oil, and mining.

From Nigeria to South Africa and Egypt, these billionaires not only shape their countries’ economies but also play key roles on the global stage.

Their wealth tells the story of entrepreneurship, family dynasties, and bold investments that have stood the test of time.

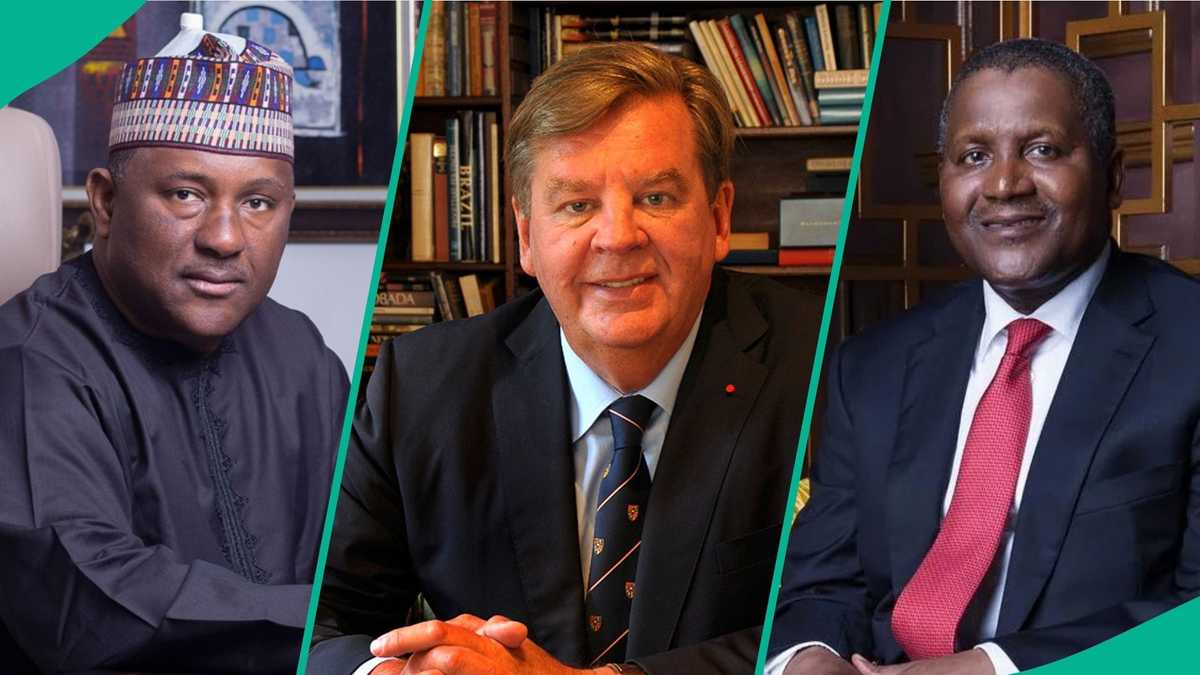

Again, Dangote retains richest man in Africa position, other billionaires change positions

Source: UGCHere are the top 10 richest people in Africa for 2025.

Aliko Dangote (Nigeria) — $23.9BAfrica’s richest for the 14th straight year, Dangote built his fortune through Dangote Cement and a fast-scaling oil refinery complex near Lagos. His group also spans sugar, salt, and packaged foods.

A prominent philanthropist, he remains the continent’s defining industrialist, with wealth tied mainly to cement and downstream energy.

Sectors: cement, oil refining, sugar/consumer goods.

Johann Rupert & family (South Africa) — $14BRupert chairs Richemont (Cartier, Van Cleef & Arpels, Montblanc) and also oversees stakes via Remgro and Reinet.

His fortune reflects luxury goods and investment holdings anchored in Switzerland and South Africa. Long regarded as a low-profile power broker, he is Africa’s top luxury billionaire.

Sectors: luxury goods, investments/holding companies.

Nicky Oppenheimer & family (South Africa) — $10.4BHeir to the De Beers diamond legacy, Oppenheimer sold the family’s 40% De Beers stake to Anglo American in 2012 and now invests through Stockdale Street and Tana Africa Capital. Wealth stems from diamonds and diversified investments after exit.

Sectors: diamonds/mining, private investments.

Nassef Sawiris (Egypt) — $9.6BEgypt’s richest person, Sawiris is an industrialist-investor with holdings spanning construction, fertilizers, European sports, and public equities (including past MSG Sports stake).

He co-owns Premier League club Aston Villa and controls OCI NV in fertilizers.

Sectors: construction/engineering, fertilizers/chemicals, sports/investments.

Mike Adenuga (Nigeria) — $6.8BAdenuga founded Globacom, one of Nigeria’s largest mobile networks, and owns stakes in oil exploration (Conoil Producing) and banking. Self-made, he scaled telecoms during Africa’s mobile boom and retains energy interests.

Sectors: telecoms, oil & gas, banking.

Abdul Samad Rabiu (Nigeria) — $5.1BRabiu’s BUA Group is a major player in cement (BUA Cement) and food staples (BUA Foods). His net worth reflects listed stakes and ongoing capacity expansions across cement, sugar, flour, and pasta.

Sectors: cement, sugar/foods, industrials.

Naguib Sawiris (Egypt) — $5.0BA telecoms pioneer, Sawiris built and sold Orascom Telecom to VimpelCom (now VEON) and has since focused on investments via Orascom TMT and gold mining platform La Mancha. His assets span media, tech, and resources.

Sectors: telecommunications, mining (gold), investments.

Koos Bekker (South Africa) — $3.4BBekker transformed Naspers from a newspaper group into a global tech and media investor (notably its early Tencent bet via Prosus). Today he is Naspers’ chair, with wealth tied to media, e-commerce and investment holdings.

Sectors: media, technology investments.

Mohamed Mansour (Egypt) — $3.4BMansour oversees Mansour Group, a vast family conglomerate with GM distribution, Caterpillar dealerships across Africa, consumer/retail, and financial investments. A former Egyptian transport minister, he has broadened the group’s global reach.

Sectors: diversified conglomerate (auto distribution, heavy equipment, retail/investments).

Patrice Motsepe (South Africa) — $3.0BFounder of African Rainbow Minerals, Motsepe built a diversified mining portfolio (platinum group metals, gold, iron ore, copper). He also holds interests in finance and sports (owner, Mamelodi Sundowns) and leads CAF.

Sectors: mining, diversified investments.

Source: Legit.ng