Homes in 37 Island Road are selling for 43% below the 2018 price (Image: Google)

Casino magnate Lawrence Ho has avoided joining the ranks of troubled Hong Kong tycoons selling assets at a loss, with the chairman of Melco Resorts and Entertainment having sold his home in the city’s exclusive Deep Water Bay area for less than half of a percent more than what he paid to acquire it 15 years ago.

The 48-year-old son of the late gambling tycoon Stanley Ho sold House C at 37 Island Road for HK$436.8 million ($56.2 million) earlier this month after having paid HK$435 million to acquire the property from developer Chuang’s Consortium in December 2010, with details of this latest sale having been listed in government records.

The new owner of Ho’s home is She Yingjie, a Chinese tech baron who founded Olympic Circuit Technology and controlled the printed circuit maker before selling a quarter stake last year for RMB 3.445 billion (then $470 million), with the home sale aligned with the expanding role of mainland magnates in Hong Kong’s luxury housing market.

“Mainland Chinese investors have now emerged as a major driving force in Hong Kong’s luxury property market, spearheading a resurgence in demand for prime level homes and reshaping the local economy,” Alex Leung, chief surveyor at CHFT Advisory and Appraisal, told Mingtiandi. “This influx of mainland buyers is not only reigniting activity in the market’s most luxurious segment, but also playing a key role in stabilizing the broader premium property market.”

Trophy Home

She, who founded Olympic Circuit Technology in 1985 and sold more than half of his stake in the company to state-owned infrastructure and property developer Shunkong Group in mid-2024, is taking possession of a home which spans 4,257 square feet (395 square metres) of gross floor area and is one of four houses in the gated 37 Island Road community.

Melco boss Lawrence Ho is selling his home for what he paid for it in 2010 (Image: Melco)

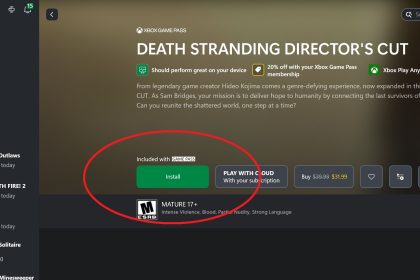

At the reported compensation, the 68-year-old is paying approximately HK$102,607 per square foot to own the address in one of Hong Kong’s most exclusive neighbourhoods, or about 43 percent less than a record price set in the same development seven years ago.

In 2018, Wang Yao, chair and chief executive of Hong Kong money lender GICL, sold House B at 37 Island Road for HK$180,000 per square foot, setting a city record at the time for the most expensive home by unit of area.

In June this year Chuang’s Consortium sold House A in the compound of semi-detached homes to a British Virgin Islands vehicle owned by mainland investor Wu Jingtao for HK$538 million. That sale price was on par with Ho’s selling price, at approximately $101,951 per square foot, with Chuang’s noting that the transaction took place at approximately 21 percent below market value.

She, a native of Fujian province took Olympic Circuit public on the Shanghai Stock Exchange in 2007 and has a net worth of RMB 10.5 billion as estimated by the Hurun China Rich List for 2025.

Bargain Buys

The Deep Water Bay home is changing hands as values in Hong Kong’s luxury residential segment continue to decline while mass residential values show signs of stabilisation.

Prices for the market’s upper tier – typically defined by properties located in The Peak and Southern Districts – registered a 2.1 percent slide in the first three quarters of 2025, compared to a 0.8 percent drop in the mass residential segment, according to Colliers.

Looking forward to 2026, JLL Hong Kong chairman Joseph Tsang expects luxury residential values to remain broadly flat while capital values in the mass residential segment are predicted to rise by about 5 percent.

Those values might be weaker still, if not for a cohort of wealthy mainland investors who have scooped up trophy homes in the city this year.

In May, Wang Baoshan, wife of Chinese selfie app Meitu’s co-founder Mike Cai Wensheng, bought a house in the city’s upscale Jardine’s Lookout area for HK$465.8 million, with that price representing a 22 percent markdown from the asking price.

Three months later, Brian Gu Hongdi, vice-chairman and co-president of electric vehicle maker XPeng, purchased a house in the same prestigious neighbourhood for HK$171 million, with that price representing a 26 percent discount from the asking price.

In July, Esther Wong Hong-man, who formerly held senior roles at mainland AI unicorn Sensetime, picked up a row house in Sun Hung Kai Properties’ Shouson Peak project for HK$125 million, or nearly 53 percent less than the project’s high-water mark in 2017.