The REIT is selling the Sumitomo Densetsu Building (centre) in Tokyo’s Minato ward (Image: Google)

Nippon Building Fund is starting the new year with a new look for its portfolio, with the Japanese REIT agreeing to acquire interests in two commercial assets for a total of JPY 46.9 billion ($300 million) and sell a 1990s-era Tokyo office building for JPY 10 billion.

NBF will buy Nihonbashi Honcho M-Square in Tokyo’s central Chuo ward from the REIT’s sponsor, real estate giant Mitsui Fudosan, and construction firm Kajima Corp for JPY 32.1 billion, according to a stock filing this week. The newly built 12-storey office building comprises 10,614 square metres (114,248 square feet) of rentable area and will be fully leased to Mitsui Fudosan for subletting to tenants.

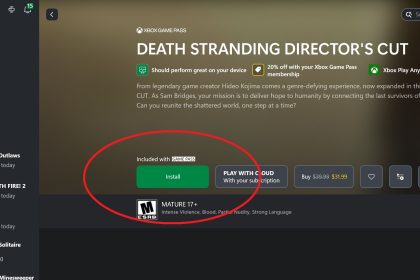

The trust is also upping its ownership in Toyosu Bayside Cross Tower, a commercial building in Tokyo’s Koto ward with office, retail and hotel components, from 47.69 percent at present to 56.88 percent by paying JPY 14.8 billion to Mitsui Fudosan. In turn, the sponsor is buying the ageing Sumitomo Densetsu Building in Tokyo’s Minato ward from the REIT.

“As a result of the transaction, there will be improvements in terms of NBF’s portfolio scale, NOI, NOI yield, and yield after depreciation, as well as reductions in average building age,” the trust’s manager said.

Skytree Views

Completed last October, Nihonbashi Honcho M-Square is a four-minute walk from Mitsukoshimae station on the Tokyo Metro’s Ginza and Hanzomon lines. The property features a standard floor area of 959 square metres, ceiling heights of 2.8 metres (9.2 feet) and a rooftop garden overlooking the Tokyo Skytree.

Nippon Building Fund executive director Kenji Iino

The transaction for Nihonbashi Honcho M-Square, valuing the building at over JPY 3 million ($19,033) per square metre of rentable area, and the additional acquisition of Toyosu Bayside Cross Tower are scheduled to close on 31 March.

NBF’s disposal of the Sumitomo Densetsu Building, translating to nearly JPY 1.7 million ($10,787) per square metre of rentable area, is expected to take place on 30 June.

Upon completion of the transactions, NBF’s portfolio will consist of interests in 70 properties with a total acquisition cost of JPY 1.56 trillion ($9.9 billion).

Aggressive Moves

NBF’s rejig comes after total acquisitions by J-REITs across the first three quarters of 2025 fell 26 percent year-on-year to JPY 760 billion ($4.8 billion), according to CBRE.

In contrast, total sales volume rose 36 percent to JPY 750 billion, slightly below 2024’s full-year, all-time-high figure of JPY 760 billion, the consultancy said in its Japan Market Outlook.

The report noted that sales volume by retail and logistics J-REITs exceeded previous annual record levels in just the first three quarters of the year.

“With J-REIT acquisition volume and sales volume almost perfectly balanced, this indicates that J-REITs are making aggressive moves to overhaul their asset portfolios,” CBRE said.