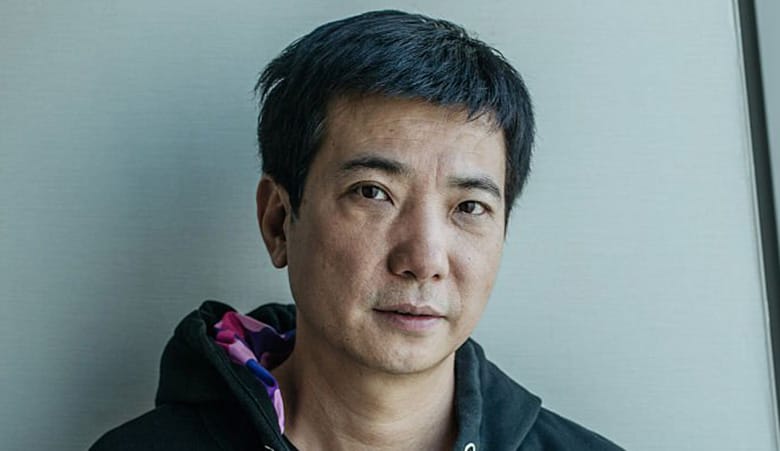

Meitu co-founder Mike Cai (Getty Images)

The wife of selfie app founder Mike Cai buys a home in Hong Kong’s posh Jardine’s Lookout, with that story leading today’s headline roundup. Also making the list, New World Development keeps bondholders in suspense as a redemption deadline nears and troubled builder China Vanke secures a fresh loan.

Meitu Founder’s Wife Buys $60M Home in Hong Kong’s Jardine’s Lookout

The wife of the co-founder of Chinese selfie app Meitu has bought a HK$465.8 million ($59.7 million) home in Hong Kong’s upscale Jardine’s Lookout area, joining a cohort of wealthy mainland investors scooping up real estate in the city at attractive prices.

Wang Baoshan closed the deal for the 5,466 square foot (508 square metre) detached house at 8 Perkins Road on Tuesday, according to the Land Registry. Wang is the spouse of Meitu co-founder Mike Cai, according to the company’s annual report. Read more>>

New World Redemption of $345M Bond Looks Shaky

Some holders of a New World Development perpetual bond said they haven’t received redemption notices on the note, as a deadline loomed that would trigger higher interest costs on the facility.

If the company doesn’t redeem the $345 million note before 16 June, its interest payments will jump to more than 10 percent from 6.15 percent, according to Bloomberg calculations. New World has to give at least 30 days’ notice if it wants to exercise the option at a lower interest rate. The price of the bond was down more than six cents in Thursday afternoon trading, Bloomberg-compiled data showed. Read more>>

China Vanke Gets Fresh $215M Loan From Shenzhen Metro

Indebted developer China Vanke has secured a RMB 1.55 billion ($215.4 million) loan from state-owned Shenzhen Metro Group, offering some respite as it looks to meet $3.4 billion in debt obligations this year.

Shenzhen’s railway operator, Vanke’s largest shareholder with a 27.2 percent stake, is extending the loan to the cash-strapped builder to help cover interest and principal repayments, according to a stock exchange filing on Wednesday evening. Read more>>

Fitch Downgrades Vanke on Liquidity Concerns

Ratings agency Fitch on Wednesday downgraded ratings for China Vanke, citing liquidity concerns amid an ailing property sector in the world’s second-largest economy.

Fitch downgraded long-term foreign- and local-currency issuer default ratings for the embattled developer to CCC+ from B-. Read more>>

Hong Kong Bankers Adjust to More Active Mainland Leadership

The crowd was taken aback as China’s point person for financial matters in Hong Kong laid out plans to re-energise the city’s markets.

Qi Bin’s proposals on topics including corporate governance were not shocking on their face, but the regulators and other policymakers gathered at the Grand Hyatt ballroom in January had rarely heard a mainland Chinese official give such detailed prescriptions on how the city’s finance sector should be run. Read more>>

Vietnam Approves $1.5B Plan by Trump Organization and Partner

Vietnam’s government has approved a plan by the Trump Organization and a partner to invest $1.5 billion in golf courses, hotels and real estate projects in the Southeast Asian country, the state-run Tuoi Tre newspaper reported Friday.

The project, planned on 990 hectares (2,446 acres) of land, will feature a complex of golf courses, resorts, hotels and a modern residential project. The investment is expected to start this quarter and run until the second quarter of 2029, the newspaper said, citing a document signed by Deputy Prime Minister Tran Hong Ha. Read more>>

Shares in Fund Manager DigitalBridge Jump on Report of Acquisition Talks

DigitalBridge jumped 22 percent amid a report that 26North Partners is in advanced talks to acquire the digital infrastructure fund manager.

Energy trader Mercuria is speculated to be partnering with 26North on an acquisition and a deal may happen within days, according to a report from IJGlobal that was circulating among traders on Thursday. Read more>>

China’s Ke Holdings Sees Net Profit Double in Q1

Ke Holdings, a Chinese real estate agent, saw its net profit nearly double in the first quarter of this year, with the mainland property market gradually recovering.

Net profit surged 98 percent year-on-year to RMB 855 million ($118.6 million) in the three months to 31 March, the Beijing-based firm said. Revenue soared 42 percent to RMB 23.3 billion ($3.2 billion). Read more>>

Tune in again soon for more real estate news and be sure to follow @Mingtiandi on Twitter, or bookmark Mingtiandi’s LinkedIn page for headlines as they happen.